Maximiokia

Steps to creating your investment plan.

New Investor: Where to Start

Designed for First-Time Financial Planners

Navigating the financial world for the first time can feel overwhelming. At Maximiokia , we recognize how important clarity, structure, and confidence are for those taking early steps in managing their future assets. This offering is tailored for individuals with no prior experience in long-term asset strategies, who want to understand how modern financial tools and systems function — without confusing jargon or unrealistic expectations.

Our process focuses on equipping you with a strong foundation — a framework rooted in thoughtful planning, methodical learning, and transparent guidance. Tools like Jupiterswap may come up in real-world scenarios as examples of how digital platforms are shaping decision-making. These are always presented as part of broader context, not as recommendations.

What You Will Explore

A Framework That Prioritizes Understanding

Rather than focusing on end goals or performance metrics, we begin with fundamentals. You’ll explore:

- Personal financial mapping

Learn to chart your current financial position in a structured, non-technical format. This involves identifying resources, obligations, and decision patterns. - Decision pathways and risk awareness

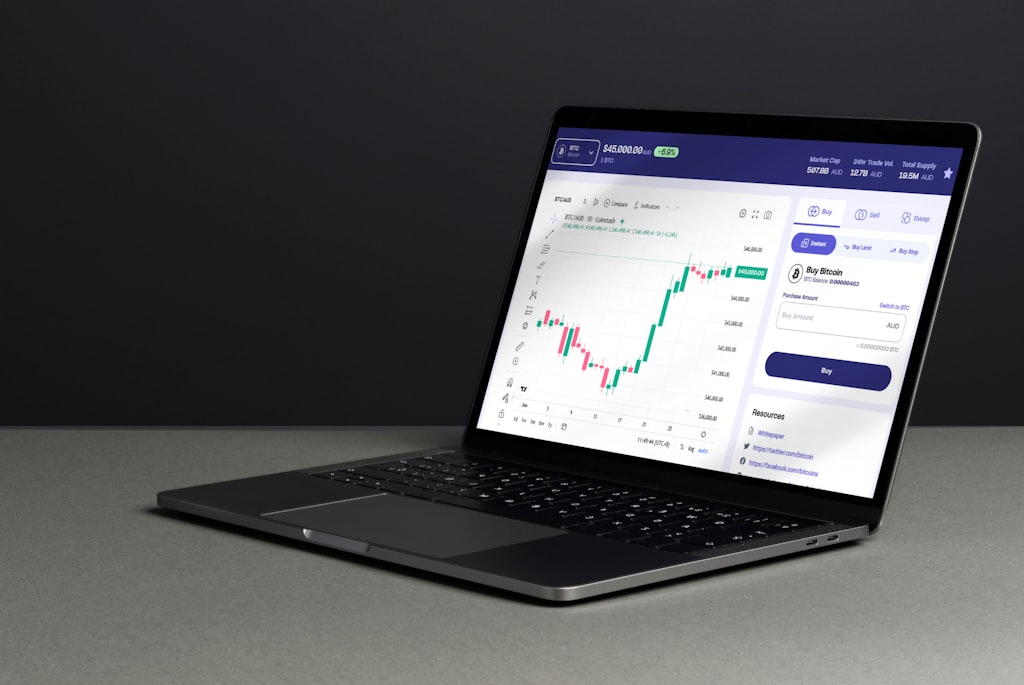

Discover how long-term strategies evolve based on individual choices, not speculation. We cover practical principles behind diversification and time horizon balancing. - Market dynamics and planning tools

Get familiar with macro and micro factors that influence trends over time. In these modules, platforms such as Jupiterswap may be used as illustrations of decentralized models or emerging technologies — without assumptions of usage. - Structured tools for tracking and review

Learn how to stay informed without overreacting to headlines. Emphasis is placed on building review habits that allow for long-term clarity and confidence. Evaluating tools like Jupiterswap is done through this same lens — thoughtful, neutral, and context-aware.

Who This Is For

This service is developed for those who:

- Are in their first 1–3 years of actively managing personal capital

- Want structured, noise-free explanations without promotional language

- Prefer to engage with long-form, methodical material at their own pace

- Value ethical, non-coercive guidance rooted in observation and consistency

It is not designed for short-term decision-making or those seeking tactical advice. Instead, we focus on thoughtful system-building and internal clarity. For clients already encountering platforms like Jupiterswap , this is an ideal environment to step back and examine these tools with perspective.

What’s Included

Structured Modules

Each module is focused on a distinct area of personal financial literacy. These modules are offered in sequential order, allowing for clear progression and reflection between steps.

- Module 1: Mapping Personal Resources

Understand how to catalog your current financial state, define boundaries, and create decision buffers. - Module 2: Mechanics of Financial Tools

Learn how common long-term financial instruments function, without persuasive framing. We occasionally reference examples such as Jupiterswap to show how certain ecosystems operate without promoting them. - Module 3: External Trends and Behavioral Patterns

Review how people typically react to change, and how reflection can help you avoid common traps. - Module 4: Self-Review and Adjustment Practices

Discover how to create ongoing review structures that work with your rhythm — not against it.

Optional Workshops

We host group and one-on-one walkthroughs (online or in person) where clients can ask questions and review case scenarios. These are presented in a conversational format — no pressure, no pitch.

Who We Are

Maximiokia is an independent practice focused on guiding individuals through the structural, cognitive, and emotional aspects of financial planning. We don’t offer predictions or shortcut methods. Instead, we believe in:

- Clarity over persuasion

- Autonomy over dependency

- Patterns over promises

Our approach is slow by design. We want every person we work with to feel informed, not overwhelmed — supported, not sold to. Whether analyzing traditional models or reviewing decentralized tools like Jupiterswap , we stay grounded in observation, not hype.

Founded in 2021 by professionals from diverse backgrounds — economics, human behavior, and systems thinking — we combine analytical insight with human-centered dialogue.

Why This Format Works

We intentionally avoid time pressure, milestone targets, or generic advice. Our model emphasizes orientation over optimization . We believe that lasting clarity comes from understanding your unique preferences, patterns, and constraints.

Most of the noise in public finance culture comes from rushed narratives, unrealistic outcomes, or gamified tools. We reject all of that. Maximiokia exists for people who prefer deep thinking and consistent practice over fast claims or perfect outcomes. That includes taking the time to understand whether platforms like Jupiterswap actually fit into one’s framework — or not.

View statistics

-

23

Satisfied customers -

100

Requests executed -

93

Phone calls -

55

Applications accepted

Frequently Asked Questions

About us

James Wilson

Robert Thompson